Naturally, you want to know an estimate of your total cost for surgery before deciding to proceed.

While it may be impossible to anticipate some of the variables that can affect cost of a surgical procedure, such as length of the anesthesia or whether specimens are obtained for laboratory evaluation, for example, the following information may be useful in understanding and estimating your own out-of-pocket cost.

Essentially, you might want to know, “What’s my bottom line?” To answer that, we need to look into what makes up the bottom line?

When a person undertakes surgery, they receive services (and bills) from a number of sources, including the facility and professional fees. While many procedures may include fees from the facility, the surgeon, and anesthesia, but additional services and fees may be generated based on the complexity of the undertaking.

Next, consider the various services and expenses associated with surgery:

Hospital or Surgical Center fee, which includes the building, supplies, nurses, and other staff.

Surgeon’s professional fee

Anesthesia professional fee

Pathologist professional fee (if a specimen is sent for pathology)

Radiologist professional fee (if x-rays/imaging are undertaken)

Medications before or after surgery

Some post-operative care by your surgeon may be performed with no additional fee.*

* Exceptions to this include care provided by your surgeon not directly related to the procedure(s) performed and care by your surgeon after the normal healing period, defined as the “global period,” which is defined according to the specific procedure(s) performed. Unplanned trips to the Emergency Room, prompt care, or another physician generate fees that are not included in the “global period.”

Consultants: if consultation of another specialty is included

Ancillary staff: speech pathology services, physical therapy, occupational therapy, dietician

Blood bank: in case of a blood transfusion

Pharmacy: medications administered during your stay

Potentially, an emergency room or primary care visit after surgery

Also, medical equipment (such as a walker) may be part of the process

All of these services generate fees. All eligible bills go through insurance in a process described below. What counts as eligible is dependent on your insurance contract. This process can be a source of confusion, but I will try to outline the main concepts.

First, a word on how medical insurance works:

Your physician’s group has a contract with your medical insurance carrier, details of which have been agreed upon by the two involved parties, which outlines the amount of money the physician’s group will be paid for a given service (e.g., procedure) performed. Keep in mind that the “fee” or “charge” is a theoretical value of what a service may be worth, but the “allowable” payment is the payment your physician’s group has agreed upon in a particular insurance contract. The difference in “fee” and “allowable” payment is usually called a “discount."

You, the patient, have a separate contract with your medical insurance carrier, the details of which have been agreed upon by you and them as part of your enrollment. Generally, if a monetary claim for a medical service rendered is considered legitimate (cannot be rejected) by your insurance company, the allowable payment is made by a combination of funds from you and/or them, according to the insurance policy contract. Many plans have a deductible and/or a graduated schedule of coverage. From a patient’s perspective, payments for all treating physicians and midlevel providers, lab tests, imaging (x-rays) are all combined into one running total that is then subject to a formula, such as the patient paying 100% of all fees until a certain deductible has been met, after which the patient pays a lower percentage of fees until an out-of-pocket maximum has been reached. Be aware that the costs of medicines may have be added up separately, and applied to a separate contract for “pharmacy benefits,” which may have its own formula for deductibles, percentages paid, and out-of-pocket maximums.

Knowing how much money you have paid out-of-pocket for your healthcare already this year may be useful to you. Your insurance company may be able to provide you with an up-to-date yearly total you have paid.

Prior authorization and predetermination:

Medical insurers have introduced the terms “prior authorization” and “predetermination” as necessary steps taken before a medical service is rendered if the insurer is to consider the associated fees eligible for their payment.

What is “Prior Authorization?”

Prior authorization, also known as pre-certification, prior approval, or pre-authorization, or pre-notification, is a process that insurance companies use to determine whether a patient is eligible to receive certain procedures, medications, or tests. This does not apply to emergency situations. More information on prior authorization may be found here.

What is “pre-determination?”

A pre-determination is a formal review of a patient’s proposed medical care compared to their insurance’s medical and reimbursement policies. Pre-determinations are more extensive reviews, and takes on average about three weeks as of this writing.

Pre-determination is promoted as a method of informing patients of a cost estimate for proposed services by verifying information regarding the patient’s insurance coverage, payable benefits, co-pays and co-insurance, details on the plan related to coverage, date of coverage, type of plan, exclusions, deductibles, and other key details about the insurance plan. It may do these things, though it may also be a source of delay in medical care. More information on pre-determination may be found here.

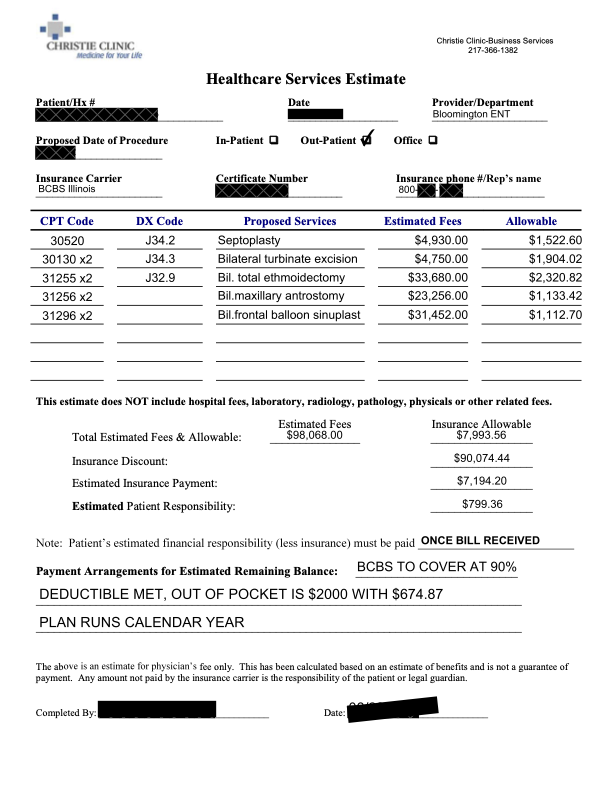

What is a Healthcare Services Estimate?

While not done at many practices, Christie Clinic provides its patients an estimate of what the patient with private insurance (not Medicare or Medicaid) will pay for a Christie surgeon’s services. This involves staff at Christie Clinic delving into the details of a given individual’s insurance plan and running the numbers as best as possible before surgery. An example of a Healthcare Services Estimate is shown below:

While the process of undergoing surgical care may be daunting in and of itself, and the financial aspects may be complicated and a source of additional concern, you may reach out to get some clarity to your questions. You may find help with your insurance company, the facility for your surgery, our clinic’s financial services (217)-366-1382.